Helping you make informed decisions on investing, money, equities and personal finance. Seasoned investors or newbie traders, our financial education corner has something for all.

Catch the latest updates from Australia’s premier stock exchange & market indices.

A very simple explanation of how Bitcoin works

Bitcoin — a popular cryptocurrency created in the late 2000s by developer/s Satoshi Nakamoto — can be complex in terms of operations. One can say Bitcoin is a digital currency that uses cryptography to record transactions. One can also say that underlying blockchain tech adds uniqueness to Bitcoin. It can also be said that Bitcoin is all about the absence of any intermediary like banks, with full control of operations in the hands of the people. The situation right now is such that even stakeholders within the cryptocurrency world lack consensus on Bitcoin.

Before one assumes anything about Bitcoin, including that it is an emerging speculative investment asset, it is important to understand how Bitcoin works. Is Bitcoin a company where staffers work in an arrangement that resembles operations of a bank? Are Bitcoin operations controlled from any headquarters? How are records of the movement of BTC tokens from one party to another maintained? Here is a simple explanation.

First, Bitcoin is also a blockchain network aside from being a cryptocurrency. Bitcoin’s mainnet is a distributed ledger, which means recordkeeping is not centralised but distributed over a large number of participants. Nakamoto imagined Bitcoin as ‘electronic cash’ or virtual money. Money makes sense only when records are properly maintained and there is no double-spending. The holder should have the ability to use the money once, and the subsequent right to spend should be passed on to the recipient.

Bitcoin functions in a manner that all transactions are recorded on the ledger by globally distributed peers. This process verifies the authenticity of transactions and prevents any double-spending. Elements like hashing and proof-of-work could be complicated, even for someone with a technical background. These simply contribute to the process of recordkeeping, with rewards accruing for recordkeepers, also known as nodes. It’s simple — when two parties transact, it triggers a record-updating exercise, which is undertaken by independent nodes that are rewarded for work done.

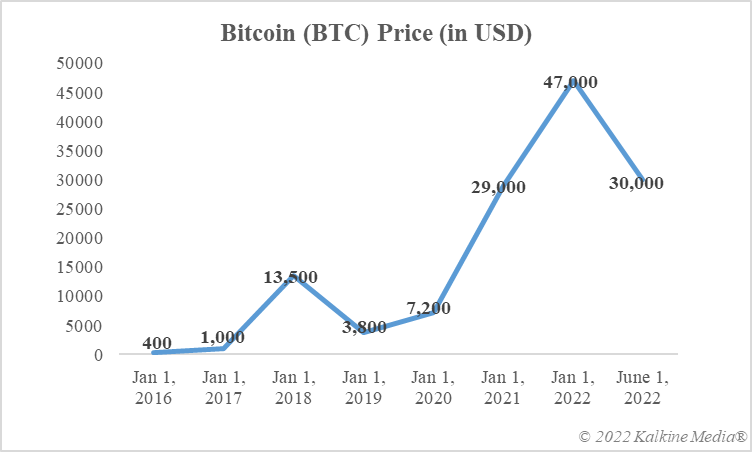

Data provided by CoinMarketCap.com

Many cryptocurrency enthusiasts focus predominantly on Bitcoin as a cryptocurrency. However, there is a definite and distinctive blockchain mainnet that exists. It is similar to the blockchains of Ethereum or Solana or Cardano. Notably, Bitcoin’s blockchain can support a so-called secondary framework, also dubbed Layer 2 in the blockchain world. Lightning Network is one such Layer 2 protocol that sits atop Bitcoin’s mainnet. When a token is mined on the mainnet, it becomes the Bitcoin (BTC) cryptocurrency.

Bitcoin can be simple to understand — considering it is a decentralised virtual currency — and also complex if one considers how recordkeeping on the mainnet is managed. Intermediaries like central banks and commercial banks have no role to play in it, and the authority is distributed among participants known as nodes. Is Bitcoin a speculative investment asset? This is another debatable topic.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

Ankit is a law graduate. He holds an interest in public policy, corporate ethics, development economics, macro-economic policies, and sustainable development….

Shaghil Bilali is a research editor with 15 years of experience in different verticals across media. He has worked with some of the leading media organisations in India. Before joining Kalkine Media, he was with Microsoft News' Canada overnight opera…

Copyright © 2022 Kalkine Media Pty Ltd. All Rights Reserved.

ACN:629 651 672 ABN:84 629 651 672

Welcome to Kalkine Media Pty Ltd. website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media LLC website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media New Zealand Limited website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media Incorporated website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

How To Make Huge Profits In A Short Time With Crypto

How To Make Huge Profits In A Short Time With CryptoGet detailed training system that shows an absolute beginner (without any skill) how to make huge profits in a short time with crypto.

Crypto + NFT Quick Start Course

Crypto + NFT Quick Start CourseThe #1 course for profit in the Crypto & NFT world - You will discover the secrets that 99% of people don’t know yet